Get this:

There is no way to know whether someone is eligible for a loan until they apply for one.

That is why getting people to apply is CRITICAL for short term loan companies.

Some companies do this by spending on traditional advertising methods.

They send postcards or put up a billboard in a particular part of town, hoping someone there needs their money.

But did you know that there are organic ways to get new application leads for your short term loan company online?

In this article, you’ll learn how to get a bunch of applications online.

It’s about to get super practical, so let’s dive in!

What marketing strategy are you using?

Postcards?

Radio?

Television?

These traditional methods all have their shortcomings.

You smack your company name in the faces of people, hoping that when they need money, they’ll remember it.

But while it may or may not work, it can get VERY expensive.

And there’s no way to track how much ROI you’re getting from it either.

What’s more, referrals are almost non-existent in the loan world.

People don’t announce that they need money. They aren’t going to ask their friends for a fair lender.

As much as possible, they will want their transaction to be private.

That’s why one of the best ways to get more loan applications is online.

Instead of taking a shot in the dark with traditional advertising, why not generate your own application leads?

Why not have the people who need your money come straight to you?

Doing this will give you a bundle of benefits.

Once you’ve set up a strong system of generating loan applications online, it’ll bring you fresh leads on autopilot.

With a healthy system, you’ll get lead after lead after lead – without having to spend for them!

Plus, these leads will come straight to you.

And the best part?

It’s NOT hard to get started.

In fact, by the time you’re finished with this article, you’ll have a firm grasp on the basics of loan application lead generation.

Which brings us to:

So how exactly do you get people to come to you online?

Three ways:

Let’s have a closer look.

What is a website for?

Is it merely a brochure of your business?

Heck no!

When you build up an excellent loan website, it can turn into a source of loan applications for you.

With a little SEO, anybody in your area that searches for “short term loans in (your city)” will find your website first.

And here’s the thing…

A LOT of people are searching for loan providers online.

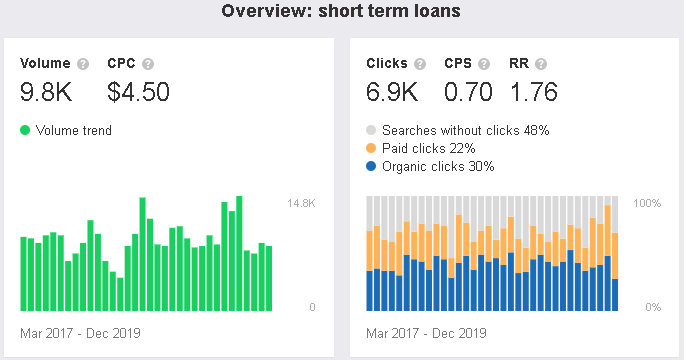

“Short term loans” is searched over 9,800 times every month!

And not only that, but people are also searching for the specific types of loans you provide.

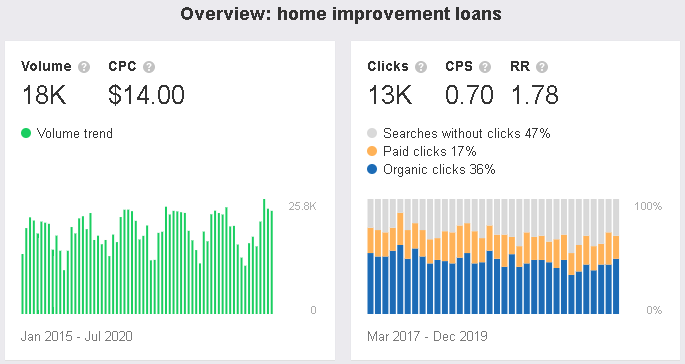

“Home improvement loans” bring in 18,000 searches a month…

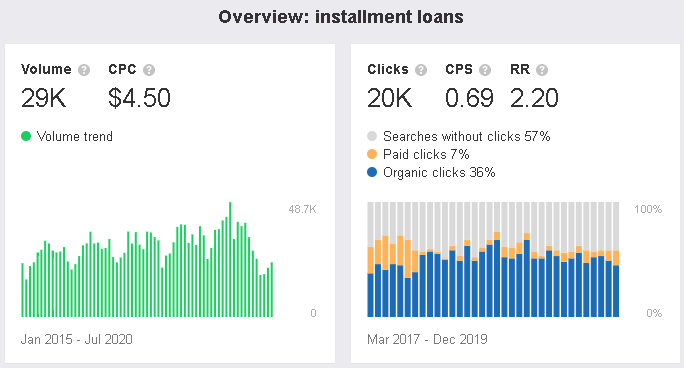

“Installment loans” 29,000…

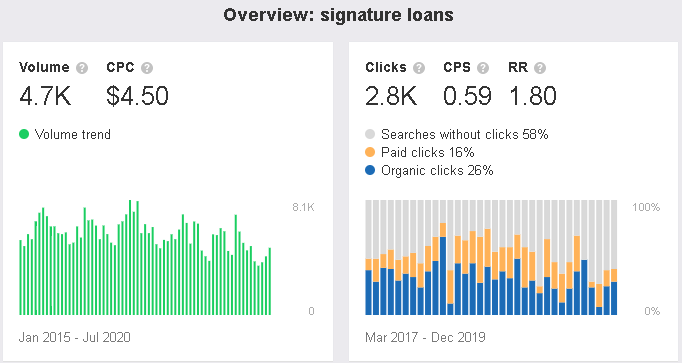

And “signature loans” 4,700.

If you look up any type of loan you provide, you’ll find that thousands of people are searching for them online.

With an excellent loan website, everybody that searches for these in your area will find you.

You won’t have to go after them anymore.

Now the big question is…

How?

You might already have a website up that isn’t producing much for your business.

What’s wrong?

What should you put on your website to make it more than just a brochure?

We’ll get to this in a bit.

For now, here are the other ways you can generate more loan application leads online.

You don’t want people contacting you from hundreds of miles away, do you?

No, you’re going after people who are as close to your office as possible.

That’s why short term loan companies target specific neighborhoods.

They try to infiltrate these neighborhoods so that anyone that needs money there will go straight to them.

Well, Google has provided you with a tremendous opportunity to do just this.

It’s known as local SEO.

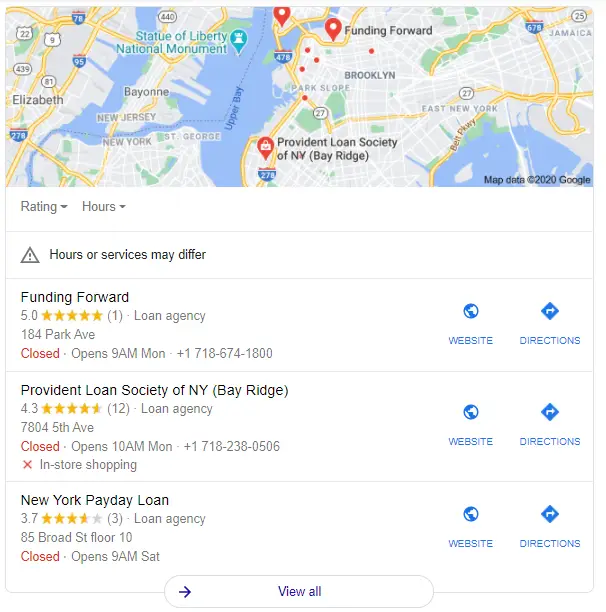

Try searching for “installment loans.” Google will give you a map-pack with three loan providers that are in your area.

Getting to the top of that map-pack is one of the BEST ways to drive in new customers to your office – or get them to contact you.

But to get there, you’ll need a solid local SEO strategy.

We covered how to set-up your local SEO strategy in-depth in our ultimate SEO guide for short-term loan companies, but let’s go over it quickly.

There are three easy ways to get your local SEO up and running.

If you want to rank in Google’s map pack, you will need a Google My Business profile (GMB).

To create one, all you need to do is head over to Google.com/business, fill up your details, and verify your address.

Once that’s done, your business will start appearing in Google maps already.

However, don’t stop there.

Make sure you fill up as much information as you possibly can in GMB.

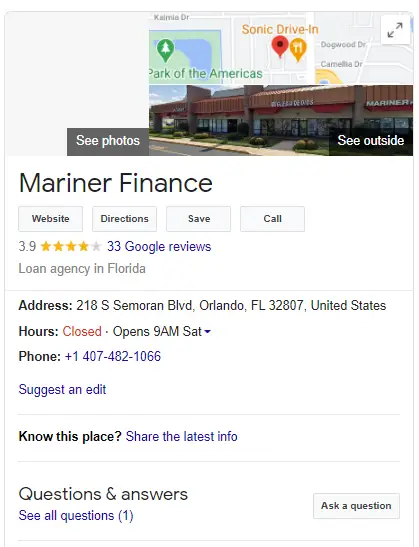

This is because GMB gives you a neat business card.

And whenever someone searches for your business, they’ll learn everything they need to know about your company.

It’s a good idea to upload some pictures as well.

Because the more information you give, the more people will trust that you’re legit.

Once your Google My Business profile is up and running, it’s time to work on getting it up the ranks.

Giving as much information as you can helps, but that alone won’t be enough.

To bump up your rank in Google maps, you’ll need citations.

Citations are anywhere on the internet where your business name, address, and phone number appear (NAP).

The more citations you have, the higher you’ll rank on Google maps.

Directory sites, such as Yelp, Bing, and Apple Maps, are great places to start building citations.

It’s super easy to add your NAP on these sites.

So go and start building a few citations!

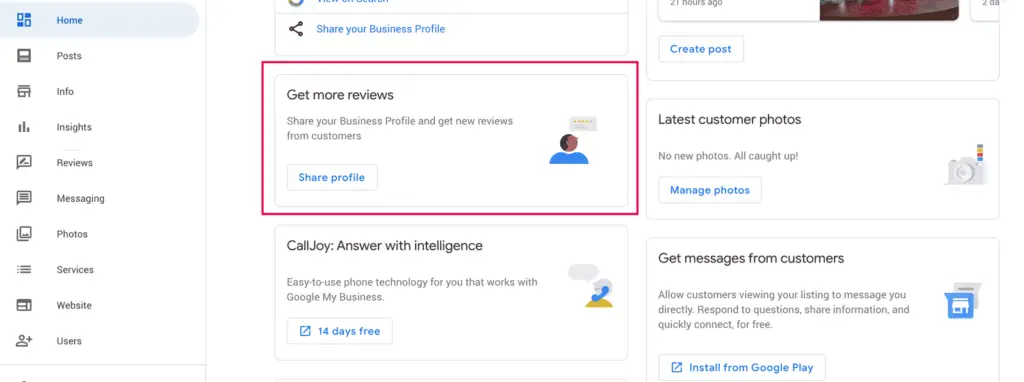

Finally, you’ll need some good reviews on your GMB profile.

It’s a good practice to ask your happy customers for a review – you’ll be surprised to find that many of them will help out.

Google My Business makes this easy by allowing you to send your clients a review link.

Good reviews go a long way in building trust with potential clients.

And, of course, it helps you rank better in Google maps.

However, there’s a catch.

You are not allowed to offer anything in exchange for a positive review.

This is strictly against Google’s policy, and you will be penalized if you are caught.

Together, these three methods will kick-off your local SEO campaign.

And if you don’t have much competition around you, these will be enough to shoot you to the top of Google maps.

However, if you’re operating in a tougher city, you’ll need to do a bit more to dominate your area.

Perhaps the best way you can do this is by getting SEO services.

Getting the services of a good SEO agency can help you claim the top spot and get ALL the business in your target neighborhoods.

Thanks to the rise of social media, branding doesn’t have to be expensive anymore.

Social media has more reach than traditional branding methods, AND you won’t have to spend nearly as much money on it.

However, like traditional branding methods, it’s going to cost you a lot.

Not moneywise, of course – we just said that social media isn’t expensive – but timewise.

If you want your social media branding to work, you’ll need to pour in hours and hours of work into it.

Half-hearted social media campaigns just don’t work.

That’s why if you’re not comfortable with taking your business to social media, it isn’t necessary for generating leads online.

Besides, like other branding efforts, a strong social media presence isn’t guaranteed to bring in new loan applications.

We always say, “Likes do not equal revenue.” However, consistent helpful information builds trust and customer loyalty.

Is your website generating new loan application leads for you?

If not, it may be because your website is nothing more than a brochure.

Perhaps all your website does is show your name, your story, and your contact information?

Those are very important, of course, but they are far from enough.

If that’s all your website has, it won’t do much for your business.

To turn this around and get an excellent website for your short term loan company, here are a few things you need to do:

Your homepage is the first page visitors will land on when they go to your website.

And, as we all know, first impressions are crucial.

However, don’t get caught up in giving your homepage a fancy design.

Remember, people don’t care about how awesome your company is – they only care about borrowing money from you.

That’s why your homepage should immediately let your visitors know what they can get from you and how to do it.

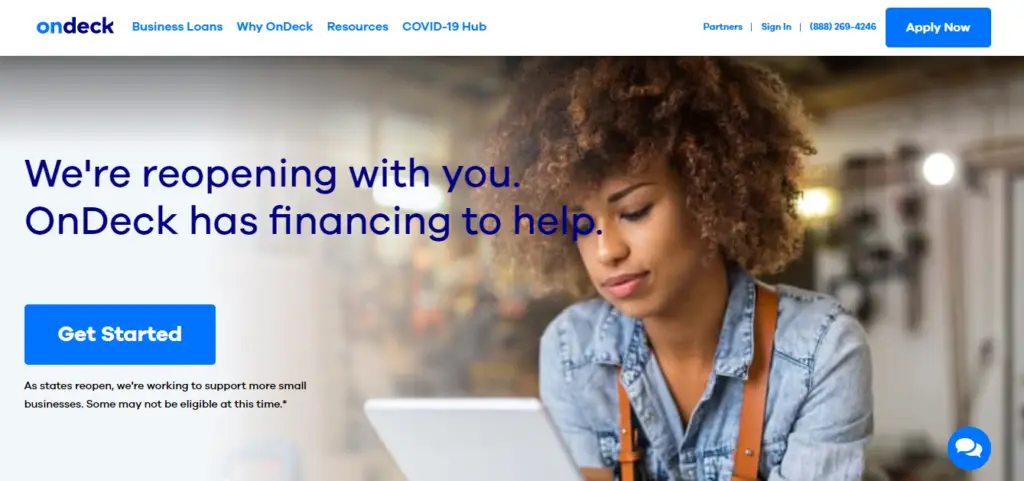

Check out how Ondeck targets their homepage at businesses reopening after the pandemic:

The homepage should be ALL about what your visitors want. It should show them what they’re looking for right away.

When you do this, you’ll find that your homepage is more like an index, and that’s good!

Homepages are the lobby of your website – they redirect visitors to the pages they want to go to.

This doesn’t mean you should cram a bunch of links in here – that will just look ugly – but make sure it’s easy for people to find the other pages they’re looking for.

One of the best ways to capture leads from your website is a big, attractive “APPLY NOW” button.

You can put this on your homepage and other pages on your website.

Clicking this will take visitors to an application page. Here, they can let you know how much they need and give you their information.

Your ultimate goal is to get as many applications as you can. Remember, there’s no way to know if someone qualifies unless they apply for a loan.

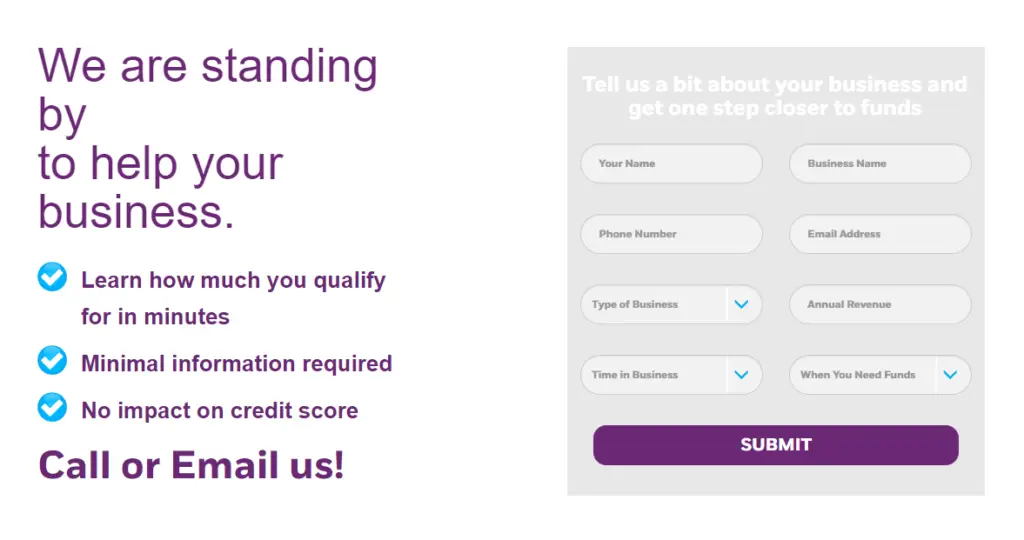

You could put up a simple application form. One that is super easy and fast for visitors to fill out.

The easier you make it for people to fill out the form, the more leads you will capture.

However, the downside to this is that you’ll also attract unqualified leads.

You might get many new leads, but how many of these you can convert into clients is another question.

That’s why it’s better to put up a detailed application form.

Ask applicants on your website for a few more details other than their name and contact number (such as who their employer is and how much they are making).

An attractive and detailed form goes a long way, like this one by CAN Capital:

You don’t have to ask them to submit any documents just yet. But this information will help you determine whether that lead qualifies for a loan or not.

Now, you’re going to get fewer applicants when you ask for more information.

But the leads that you’ll get from this will be ultra-valuable leads.

Often, all it takes is one phone call and a visit to turn them into your customer. Or, if you’re licensed to provide online loans, the entire transaction is done online.

Your visitors need to know what types of loans you offer.

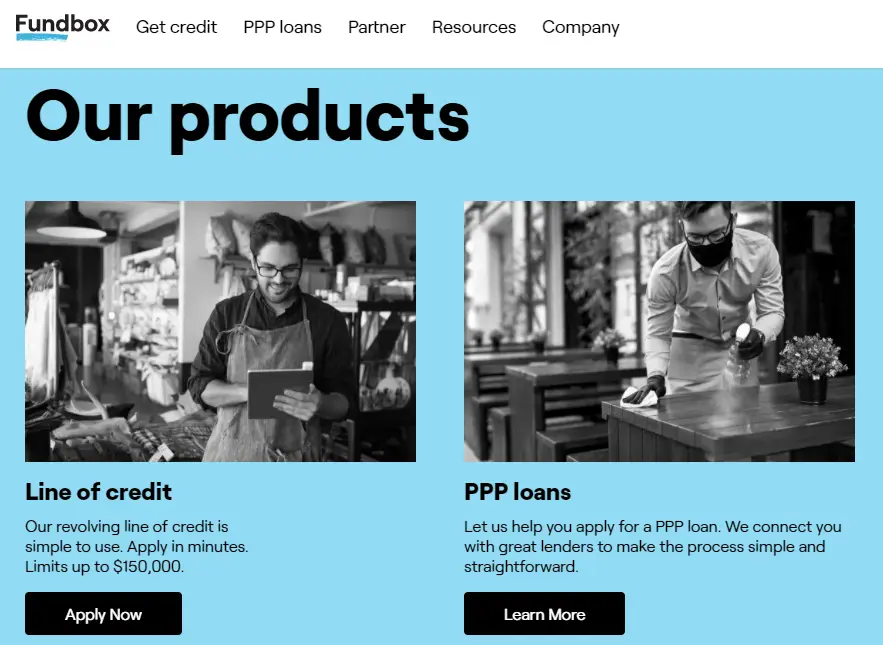

A good example of this is in FundBox’s website, where they show visitors right away what they offer:

But don’t stop there.

If you want your website to go from mediocre to excellent, you need to fill it up with high-quality, informative content.

So in your services pages, instead of just writing down what you do, give details about everything borrowers need to know about that type of loan.

If you offer auto title loans, write an in-depth article about it.

This will do two things:

One, it’ll help your potential clients understand how that type of loan works and what they need to prepare when getting one.

And two, it’ll help with your SEO (which we cover in our ultimate SEO guide for short term loan companies). This will help your website get to the top of search engine results.

Do you have multiple locations?

If so, it’s a great idea to create separate pages for each one.

It might be more convenient to list all of their addresses in one “locations” page, but this isn’t ideal for local SEO.

With a separate page for each one, you’ll expand your reach and can rank for more local SEO keywords.

Remember, you’re not trying to rank for a keyword like “cash loans.”

That keyword is far too broad.

Instead, you’re looking to rank for keywords like “cash loans in Manhattan” or “cash loans in the Bronx.”

If you lumped all your NYC locations into one page, you wouldn’t rank for either of those keywords.

So separate them, and create a page for each of your locations.

And don’t just show the office’s address on these pages. Make a short write up on the types of loans you offer as well.

This allows you to sprinkle in more relevant keywords and drive in more valuable traffic.

Finally, make sure you add that big shiny “APPLY NOW” button.

Remember, the goal is to generate those fresh new applications.

With those tips and tricks, you can start grabbing new loan applications all by yourself.

But, get this, it’s going to take a LOT of work.

And everything in this article is really only the basics.

If you really want to grab ALL the loan application leads in your area, that’s something only professional SEO services can do for you.

Here at The Gallas Company, we work hand-in-hand with short term loan providers to create excellent websites and help them DOMINATE their area.