How did you fare during the coronavirus pandemic?

A LOT of tax preparers had it rough during the lockdowns.

However, while everyone else struggled, some tax businesses never stopped getting new tax leads.

And we’re not talking about the Intuits or the H&R Blocks – who are just too large to be badly affected by a lockdown.

We’re talking about small and medium-sized tax offices.

Their secret?

They were getting new tax leads online.

In this article, you’re going to learn just that:

All in super-specific and practical steps, so you can work on it today.

Let’s begin!

Before jumping into how to use and build your website for tax leads, let’s first examine why.

Why should tax preparers work on getting online tax leads?

Everyone knows that referrals are the bread and butter of tax businesses.

It’s what most tax offices have used for years to get new clients.

However, if you don’t work on taking your business online, you’re going to miss out on a LOT of potential business.

Here are some reasons why it’s crucial to start doing this as soon as possible:

Referrals only go so far.

Unless you have a referral champion – who tirelessly recommends your services to everyone they meet – the most someone will do is mention you once or twice (if they mention you at all).

Yes, someone might get their whole family to work with you, but referrals rarely go farther than that before drying up.

And once it dries up, you’re back to square one.

Contrast that to online tax leads.

You can work on your website today, and it can bring you lead after lead tomorrow.

A strong website will pull in tax leads on autopilot. You don’t have to ask someone for help for this to work.

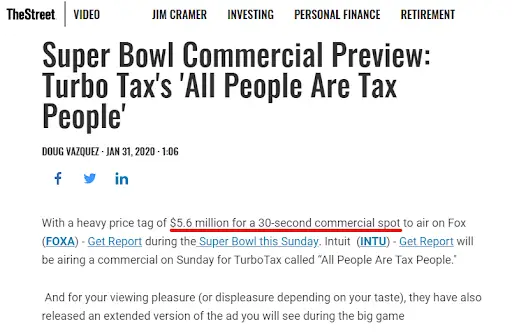

Remember H&R Block’s Superbowl 51 commercial?

Or TurboTax’s “All People are Tax People” commercial in the Superbowl 54?

Those companies spent around $5 million on those ads.

And it didn’t hurt them at all.

Because they’re so huge, companies like H&R Block or Intuit can dump tons of money into advertising campaigns to brand their company.

For small and medium-sized tax offices, though?

A Superbowl commercial is a daydream.

Branding can be way over the budget.

Sure, you can market through postcards, radio, or telephone – but all those methods cost a lot and bring back tiny returns.

By all means, branding isn’t an efficient way to get clients. Only companies who have loads to spend can get good returns from it.

You may have grown up at a time when asking a friend was the best way to get answers.

Gen Z kids, however?

They go straight to Google.

And as the first wave of Gen Zs move out of home and get into the workplace, they’re going to start looking for tax preparers.

Where will they go for help?

Google.

That’s why getting your tax preparation business online is crucial – both for now and the future.

Every year, thousands of people who grew up in the internet age are going to need tax preparers.

And the BEST way to get to them is right in their comfort zone – online.

Building up an online presence is vital for tax preparers.

But how do you do it?

There are 4 ways you can get tax leads online.

Let’s take a quick look at them, then dive into the super-practical steps you can start working on right now.

Have you ever looked up a business online?

Why did you?

Most likely, you were thinking about doing business with them – but wanted to learn more about them first.

The same goes for people looking for tax preparers.

Nowadays, when someone recommends your services, many people won’t take their word for it.

Instead, they’ll do some of their own research first.

And if nothing shows up when they search for your name?

They’ll go away with the impression that you’re not legit – or at least not very professional.

That’s why putting up a decent website is critical (keyword: decent, not extravagant – more on this in a bit).

This way, your website will pop up whenever someone searches for you. And as they browse your website, it’ll build more and more trust until they’re ready to get your services!

But that’s not all yet.

No, there’s a lot more you can do with your website to get tax leads.

It’s much easier to go after leads than to wait for them to contact you.

On that note…

What type of taxes do you specialize in?

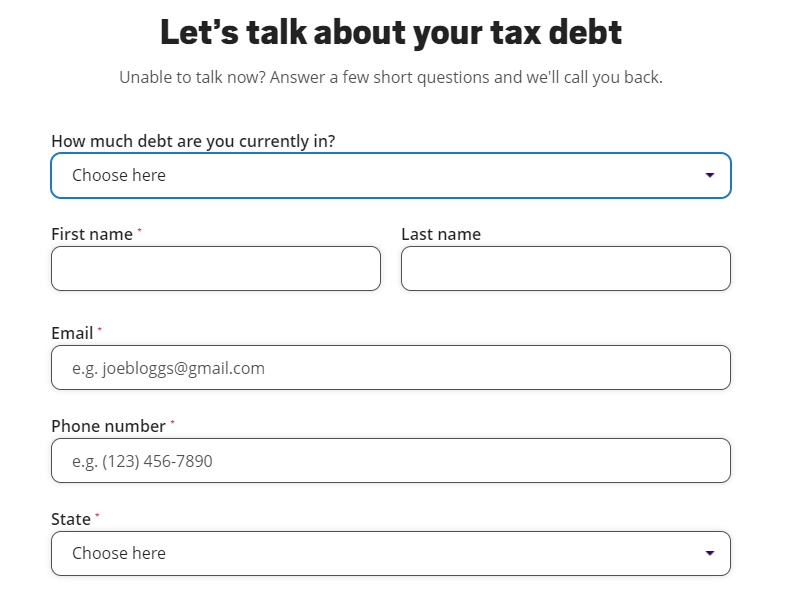

If you have in-depth knowledge about a super-specific situation – say, property taxes in Chicago – you can turn that into a lead capture.

How?

Pile everything you know about Chicago property taxes into one pdf. Make it the ultimate resource for anyone with problems with property taxes in Chicago.

Then, put it up on your website for free!

But don’t give it away for nothing.

Instead, anyone that wants it has to give their name, email address, and phone number first… a lead capture!

This way, you’ll get some fresh leads whenever someone downloads your guide.

The best part?

These are HOT leads.

When people download this guide, you know that they already have problems or questions about property taxes in Chicago – something you can help them solve.

So ring them up! With your expertise in their situation, you can easily convert these leads into clients.

Again, it’s easier to go after clients than to wait for them to call you.

Also, you don’t have to give a free pdf. You could do what Jackson Hewitt does, and promise to help people solve their tax problems if they drop their contact information.

With a lead capture on your website, you can get information on people who are very likely to need your services.

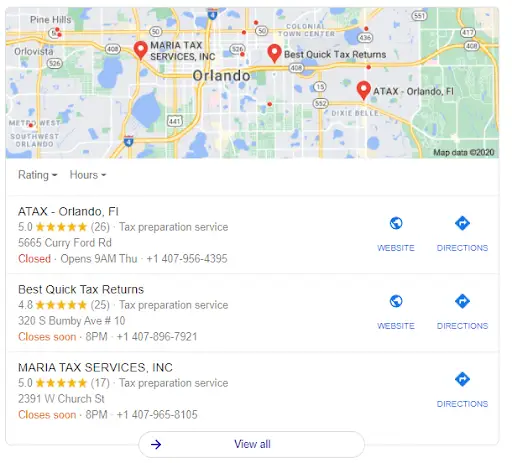

Try searching for “tax preparer” in Google.

You’ll get a little map showing you three tax businesses near you.

This pop-up is known as Google’s map pack.

As a tax preparer, one big win you should chase after is getting into that map pack.

Once you’re in there, you’re going to get a LOT of leads. Because anybody that searches “tax preparer” in your area will find you first.

But to get there, you’ll first need to do some local SEO basics.

The good news?

It’s super simple.

All you have to do are three things:

We covered these steps in-depth in our ultimate SEO guide for tax preparers.

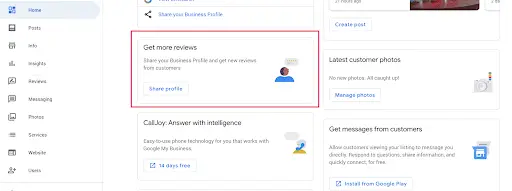

Basically, all you have to do is create a Google My Business profile by heading over to google.com/business, filling up your details, and verifying your address.

From there, you can then start listing your business name, address, and telephone number (NAP) on directory sites like Yelp, Bing, or Apple Maps. These will push your GMB profile up the map pack rankings.

Finally, to give your GMB profile a boost, start asking your clients for good reviews. GMB allows you to send them a review link, which makes it a lot easier for everyone.

Now, these are only the bare-bones local SEO techniques that you should do yourself.

They will get your local SEO up and running. However, unless you’re in a low-competition area, these won’t be enough to put you on top of the map pack.

To get there, you’ll need the help of a good SEO agency.

If you want to get into branding but don’t have money to burn, you can go for social media.

Social media is cheap, has millions of users, and may or may not win you some new clients.

However, like other branding methods, you’ll have to pour a LOT in for tiny returns. Not money, but time.

If you’re only going to spend a few minutes working on your social media, you won’t get anything from it.

And a lot of tax preparers aren’t comfortable with getting into social media either.

That’s why growing your social media presence is optional.

If you’re comfortable, then sure! Go ahead and brand your tax preparation business on social media. You might just build a following.

If not, you won’t miss out on a lot.

A great tax preparer website does 2 things:

If you don’t have a website yet, you might be wondering what the best way to get one is.

Or you might be wondering what exactly you should put on your website.

Maybe you want to know what the difference between a great and a bad tax preparer website is?

Well, this section will answer those questions and more.

Plus, it’ll also give you warnings on mistakes many tax preparers make.

Here’s how to get a great website for tax preparers:

If you search “tax preparer website developer,” you’ll get some tempting offers.

You’ll find that for as low as $30 a month, you can get a pre-curated tax website complete with tax tools and ready-to-publish content.

All you have to do is select a design and adjust the content to fit your business. You won’t ever have to think about website building or coding.

Sounds great, doesn’t it?

Well, not really.

The problem with this is that your tax website is going to be like everyone else’s. Even if you adjust the content, many of it will still be duplicated on another website (which can be a problem for SEO).

And the tax tools?

Nobody cares about them.

A decent and straightforward tax website is far better than an extravagant one filled with tools.

People don’t go to a tax preparer website to use a tax calculator. They’ll go there because they want you to do the calculations for them.

That’s why it’s best to skip the pre-curated tax websites.

They look nice, and they’re probably the easiest way to get a tax website up. But for looking professional and gaining new leads, these sites won’t do you much good.

If you’re serious about growing your online presence and getting more leads, you’ll go for another method that gives you more control.

Alright… so what are your options?

With a little searching, you’ll find that there are dozens of good website builders.

Choose one that’s affordable, super easy to use, and fully customizable.

A great option you have is WordPress.

WordPress powers about 35% of the internet. And you don’t have to be a web developer to use their .com version (wordpress.com) either.

With it, you can easily build a website for free. But don’t settle for that. Grab the paid version to enjoy your custom domain (which looks far more professional).

You also have several other options. As a rule of thumb, avoid free website builders. There are far too many drawbacks that you’ll run into with these.

But on the flip side, don’t spend too much on a website builder.

Remember, you’re going for a professional yet simple website.

Once you have that, you can then move on to working on your SEO.

So you have a website.

Great!

Now what?

What exactly should a tax preparer put on their website?

You might find yourself confused as to what to do next.

That’s why the offer of a pre-curated tax website with ready-made content is so tempting for tax preparers.

Well, if you want your website to look professional, here are the 4 essential things you should add:

First impressions are critical.

Everyone knows that.

When it comes to your tax website, your homepage is the first thing visitors will see. That’s why you should make it look as professional as possible.

Again, it doesn’t have to be fancy. A neat website makes a much better first impression than a website with tools all over the place.

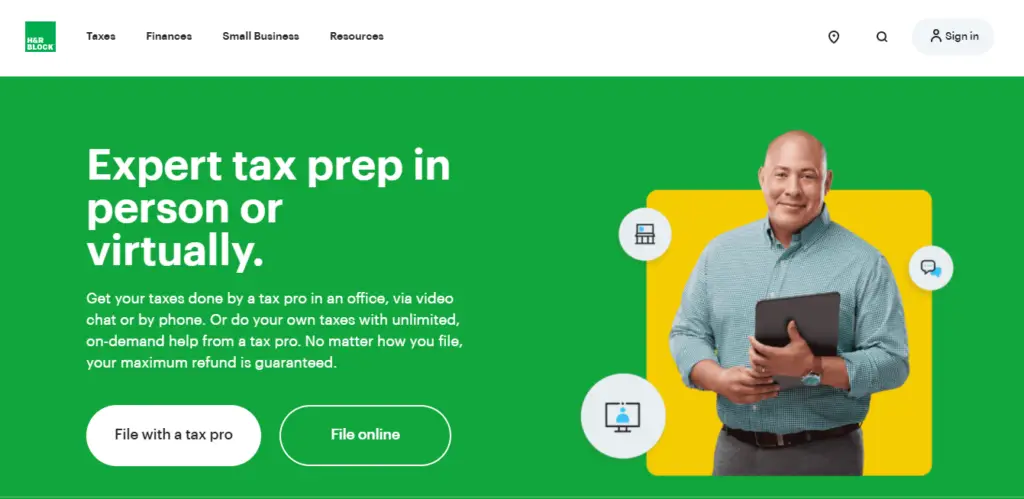

Keep it simple and clean, like what H&R Block does:

If someone searches your name on Google, what comes up?

Is it your website? Your LinkedIn? Or is it your Facebook profile with you chugging down a beer?

The LAST thing you want when potential clients search your name is for them to find unprofessional pictures of you.

Instead, you want them to find your website, where you look professional and ready to handle their taxes.

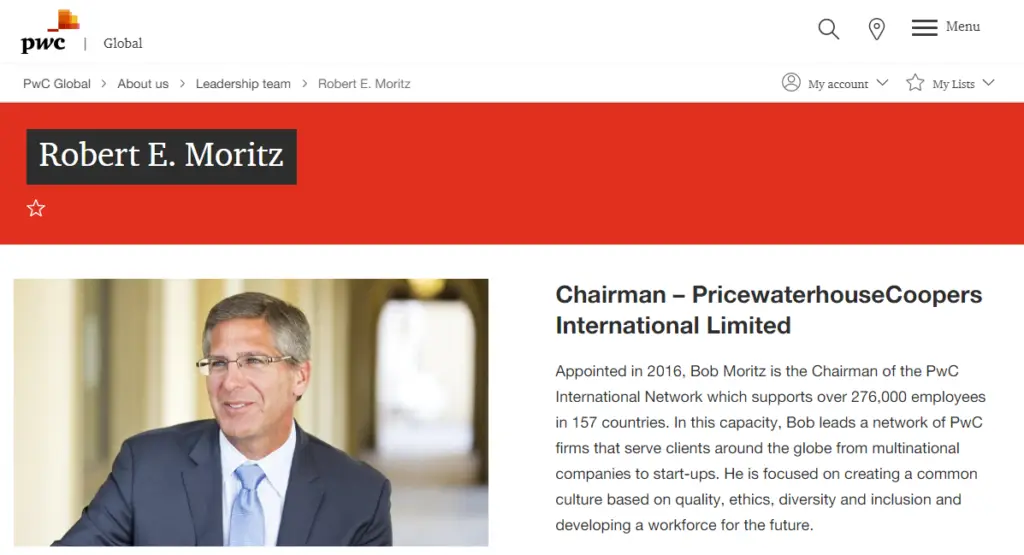

That’s why the About Page is so important.

Put your name, a high-quality picture of yourself, as well as any details about yourself you want to share.

A good example is Robert Moritz’s page on the PwC website.

Aside from that, you should also put some details about your company.

Next up, you’ll want to put up the services you offer.

Here, you’ll give visitors an overview of all the services you provide and the area(s) you serve.

This page is critical for your local SEO push. It’s here that you’ll add the keywords you want to rank for.

These keywords should be extremely specific. And these keywords should ONLY be local.

You’re not trying to rank for “tax preparer.” There’s about a 00.01% chance you’ll rank for that keyword (even less).

You’re also not trying to rank for “tax preparer in California.” That keyword is just too broad.

Instead, you’re going for your target audience. You’re going after people who are just a drive away from your office.

How far a drive depends on how much competition you have.

If you’re in New York City, use precise keywords like “tax planning services in the Bronx.” But if you’re in a state like Wyoming, you can probably target your entire county.

Keep that in mind as you build your services page. This is one of your most valuable pages for local SEO.

While not necessarily a separate page, you should never forget to add your lead capture if you have one.

One good idea is to create a “resources” page.

Don’t just dump the pdfs in here. Instead, write something short about the contents of the files. Then, visitors have to give you their info to access the full pdf.

Make sure to add the right keywords here as well so that people can find it through search.

And that’s it!

Those are the 4 critical things to have on a tax preparer’s website.

You can add more if you need to. But avoid filling up your website with pages nobody cares about. Every page on your website should provide value for your visitors.

Once you’ve set up your website, you’re ready to start getting online leads!

However, everything in this article is only the beginning.

If you want to grab ALL the tax clients in your area, you’ll need to take it a step further.

And that is something that only professional SEO services can do for you.

Here at The Gallas Company, we can take your tax preparation website to the next level. With our advanced local something techniques, we can help you DOMINATE your area.