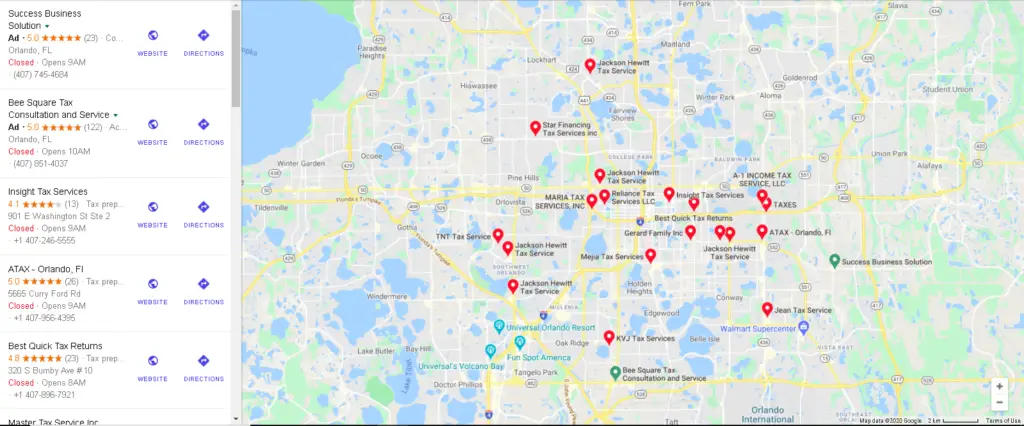

The good news?

It’s super easy to get started.

All you have to do is head to Google.com/business, click on “manage now,” and fill up your business details.

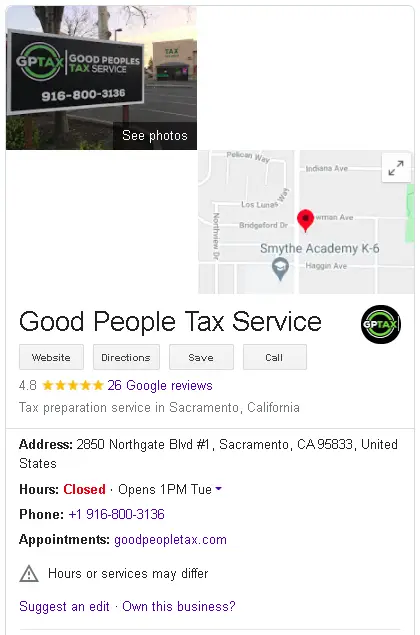

That said, you don’t want to rush your Google My Business profile.

When filling out your business details, make sure you give as much information as possible (and make sure it’s all 100% accurate).

If possible, don’t leave anything blank. The more details you give, the better Google can index your business – and the higher you’ll appear on search engines.

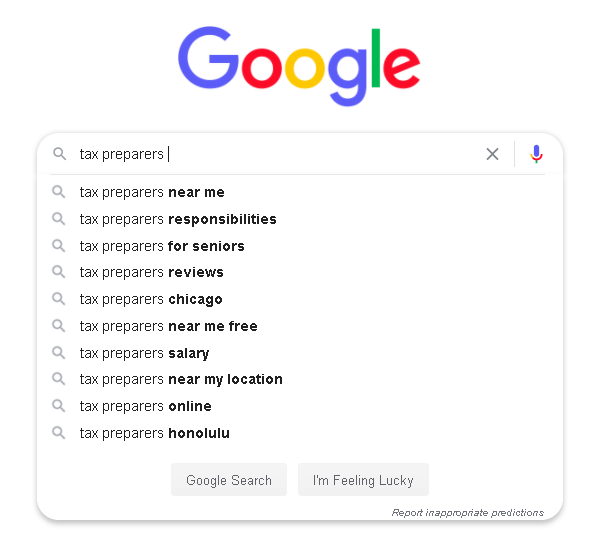

One secret tip is to sprinkle keywords in your business description.

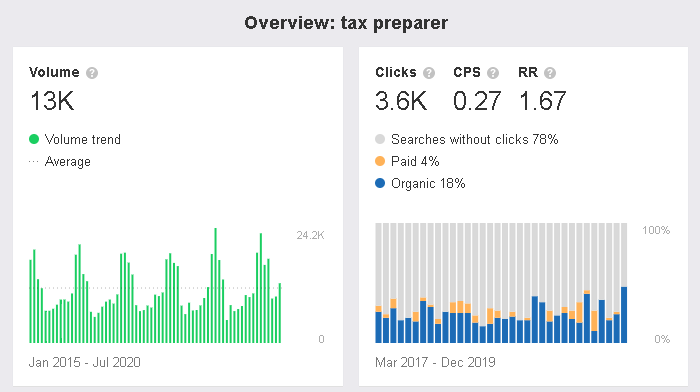

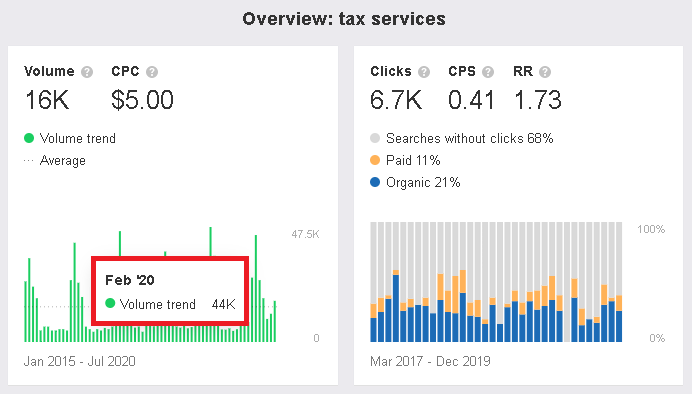

No, don’t stuff “tax services” or “tax preparer” until your description is unreadable. But give a clear and helpful description while sliding in keywords where they fit.

Quality over quantity always.

Another secret is to add high-quality images.

When your Google My Business profile is full of great photos of your business, you’ll not only get a better rank, but it will also build trust with potential clients.

Google will guide you on the photos you need to add (your logo, your office, your banner, etc.). Uploading all of these is a must.

You may also want to add 3-4 other photos to give people more ideas of what exactly your business looks like.

Expert tip: If a well-known influencer does business with you, ask them for a photo in front of your office. Then, with their permission, upload it to your Google My Business profile. It’s a sneaky little way to market your business that works.

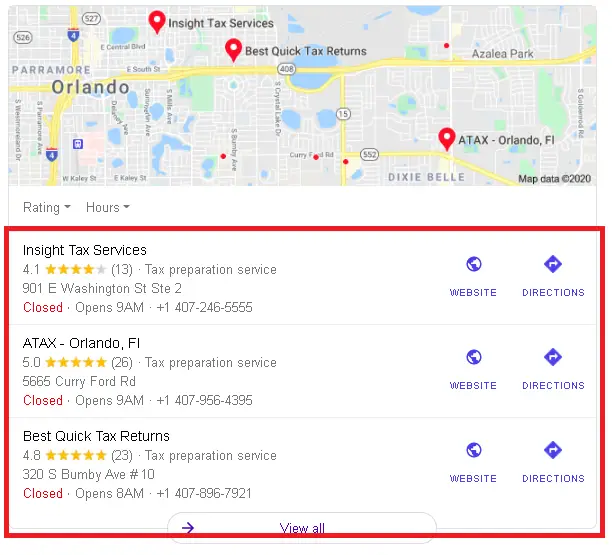

There are a few other ways to optimize your Google My Business profile.

All of them follow the basic principle:

Give as much relevant and useful information about your business, and Google will put you higher on search results for it.